You work hard, hauling loads, completing projects, and building your business from the ground up. But even with a full schedule of jobs, sometimes it feels like the money isn’t flowing in as smoothly as the dirt out of your truck. This is where cash flow management comes in – it’s like keeping your fuel tank full so your engine never sputters. It’s about making sure you have enough money coming in to cover what’s going out, so you can not only keep operating but also grow.

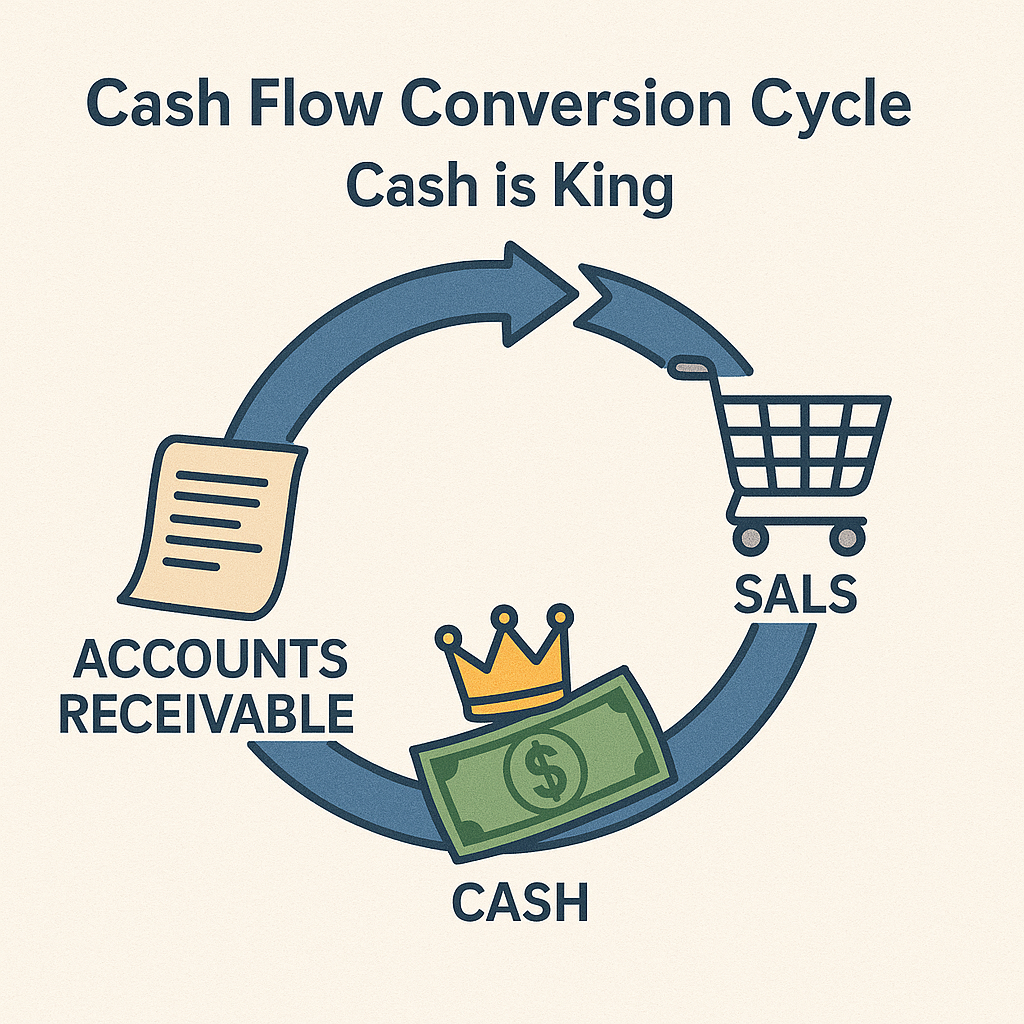

One of the biggest puzzle pieces in this whole cash flow picture is accounts receivable. That’s just a fancy term for the money your customers owe you for the jobs you’ve already finished. For a dump truck operator, these are your unpaid invoices. And let’s be honest, waiting weeks or even months for a payment can be incredibly frustrating.

The Hidden Cost of Slow Payments

Here’s the tough truth: loose collections on accounts receivable will absolutely hinder your growth. Imagine you’ve got a fantastic opportunity to take on a bigger project, maybe even add another truck to your fleet. But if you’re waiting on thousands of dollars from past jobs, that money is tied up. It’s like having your truck parked and idle when it could be out making you money.

When payments are delayed:

- You might struggle to pay your own bills: Fuel, maintenance, payroll, insurance – these expenses don’t wait for your customers to pay.

- Growth opportunities pass you by: You can’t invest in new equipment, hire more drivers, or take on larger contracts if your funds are stuck elsewhere.

- Stress levels rise: It’s tough to focus on driving your business forward when you’re constantly worrying about when the next payment will hit your bank account.

The challenge is real. Contractors often have their own payment cycles, and sometimes things just move slowly. But you have the power to take control and make sure your cash flow is strong.

Your Strategy for Smooth Cash Flow

So, how do you make sure that money flows in consistently, allowing you to grow without constant worry?

1. Set Clear Payment Terms (and Stick to Them): Right from the start, be clear with your clients about when you expect payment. 7 days? 30 days? Whatever it is, put it in writing and discuss it. This sets expectations and helps avoid misunderstandings later.

2. Invoice Promptly and Accurately: As soon as a job is done, send that invoice! Make sure it’s accurate, detailed, and easy for your client to understand. Errors can cause delays.

3. Follow Up, Politely but Firmly: Don’t be shy about following up when an invoice is due or overdue. A friendly reminder email or call can often do the trick. Remember, you’re not asking for a favor; you’re asking for money you’ve earned.

4. Consider a Cash Flow Accelerator like Factoring: Sometimes, even with the best follow-up, waiting 30, 60, or even 90 days for payment just isn’t feasible for a growing business. This is where factoring services become a game-changer.

Think about ChummyFunding’s Cash Now Factoring and other factoring services. How it works is simple: you complete a job, send your invoice to ChummyFunding, and they advance you a large percentage of that invoice amount (often 80-95%) almost immediately. Then, they handle collecting the full payment from your customer. Once collected, they send you the remaining balance, minus a small fee.

This is a key strategy for cash flow management because:

- Instant Cash: You get access to the money you’ve earned much faster, eliminating those long waiting periods.

- Accelerated Growth: With immediate cash, you can take on more jobs, cover operating costs, invest in equipment, and grow your business without being held back by slow-paying customers.

- Reduced Stress: You’re not spending your valuable time chasing payments, allowing you to focus on what you do best – operating your dump truck and building your business.

- No Debt: Factoring isn’t a loan, so you’re not taking on debt. You’re just getting paid for your work sooner.

Powering Your Future

Managing your cash flow effectively, especially your accounts receivable, is not just about avoiding problems – it’s about unlocking your business’s full potential. It can be a challenge, but with clear communication, diligent follow-up, and powerful tools like ChummyFunding’s factoring services, you can transform slow-paying invoices from a roadblock into a runway for accelerated growth. Keep those wheels turning, and your business will thrive!